Press Cutting

Press Cutting

Camphill Village Trust – a members story

Published in CHIC (Communities & Housing Investment Consortium) Newsletter ‘CHIC CHAT’ – February 2023 Camphill Village Trust, a recent new member, contacted CHIC with an urgent requirement for Stock Conditioning Surveys.

Press Cutting

Lucy Frazer out as housing minister – property industry reaction . . .

Published in Property Week on 7 February 2023 and EG on 8 February 2023 Lucy Frazer is leaving her post as housing minister at the Department of Levelling Up, Housing and Communities, to become the secretary of state for the Department for Culture, Media and Sport (DCMS), as part of prime minister

Press Cutting

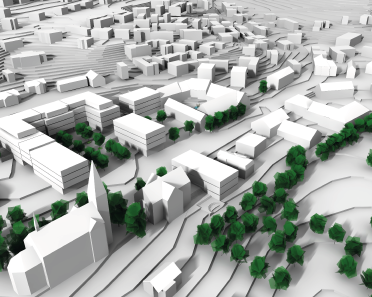

Community Land Auctions not a practical solution

Letter published in Property Week on 20.